Free Printable Bill Tracker: Manage Your Monthly Expenses

Use this free Monthly Bill Tracker printable to stay organized and pay your bills on time.

It is one thing when you actually do not have the money to pay your bills, but it is another thing when you forget to pay because you are unorganized.

You can instantly download the Monthly Bill Tracker printable below. Or, if you prefer, you can download my entire Budget Binder (it’s free) and it includes the bill tracker printable.

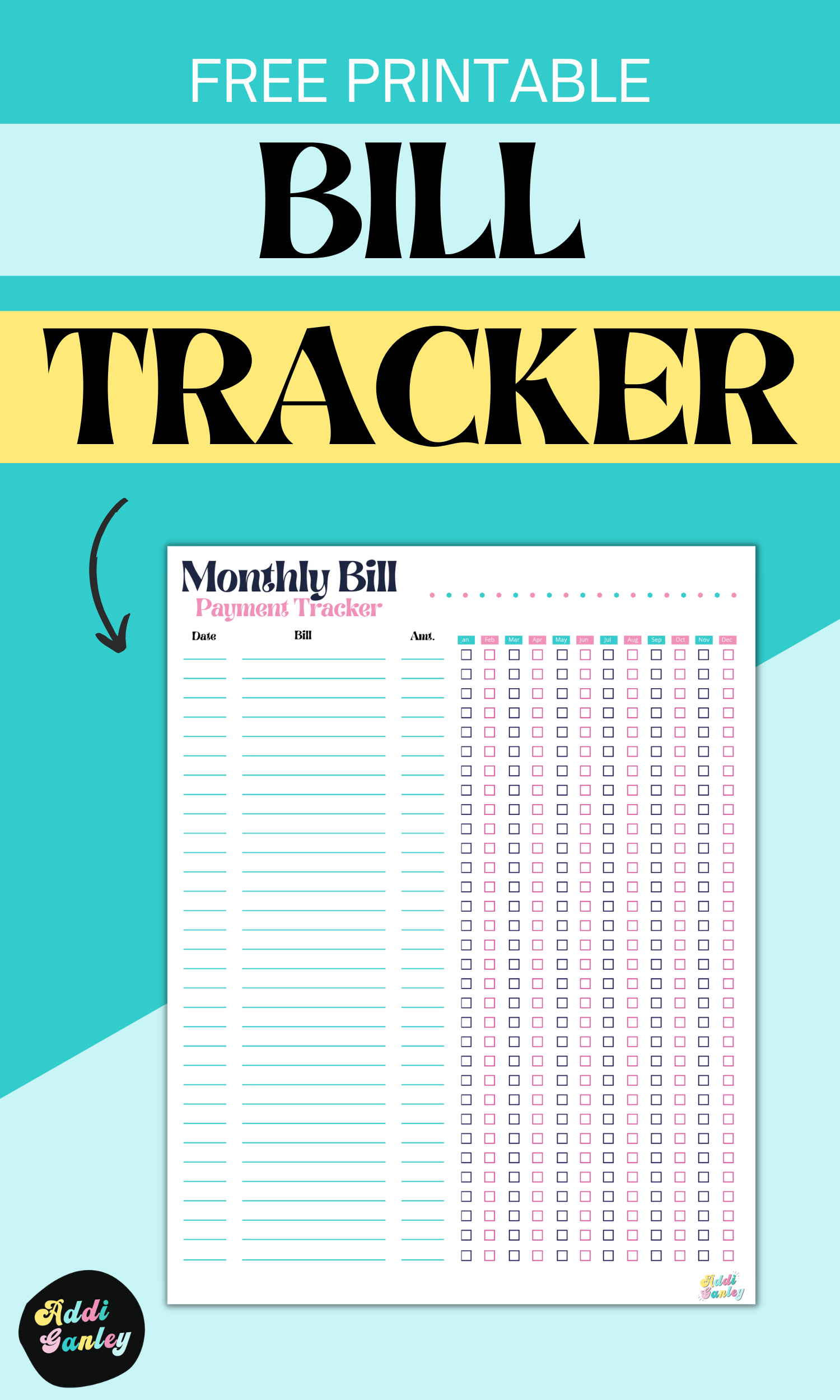

Printable Bill Tracker

I hate to admit it but I have definitely forgotten to pay bills on time. It already hurts to pay so much money in monthly bills, but I HATE late fees.

They can be completely avoided if you know exactly when your bills are paid each month. This is why I use a monthly bill tracker.

It is an easy way to list all of my monthly bills in one spot.

It also helps me to see all of my bills from an aerial point of view. I know what bills I have when I paid them and how much is owed.

I like to reference it often to make sure it is all correct when I do get a late fee or a huge increase in one of our monthly payments.

Once you print this bill tracker you can fill in the due date of the bill, a description and the amount due.

For example, if your mortgage is due the first day of the month you can write in 1st - Mortgage - $1200. Then, check off the box for each month as you pay it.

It is easier if you put your bills in order by their due dates and then you can check off once they are paid each month.

Some payment amounts fluctuate so you can leave that line blank or give a general amount so you know what to budget for.

I am sure throughout the year more monthly bills will arise so you can add to this at any time or print two copies.

Paying your bills on time and avoiding late fees can help to increase your savings account and help to prevent damage to your credit score.

Print your free monthly bill tracker now.

Ready to take control of your finances in 2025? Our FREE Budget Binder includes 85+ printable pages with debt trackers, savings goals, monthly budgets, and more. These proven tools have helped thousands get out of debt and build savings. Download now and transform your financial future!